BlockchainFX Presale: Analyzing the 'Altcoin Alternative' Claim

Deconstructing BlockchainFX: An Analysis of a High-Stakes Bet on Utility

In any turbulent market, capital flows toward perceived safety or, conversely, toward asymmetric upside. We’re currently witnessing a textbook example of this bifurcation. Established protocols like Polkadot and Chainlink, once the darlings of innovation, are now being stress-tested by a market that values immediate returns over long-term technological promise. Their price action has become a source of frustration for holders who see immense technical value but lagging financial performance.

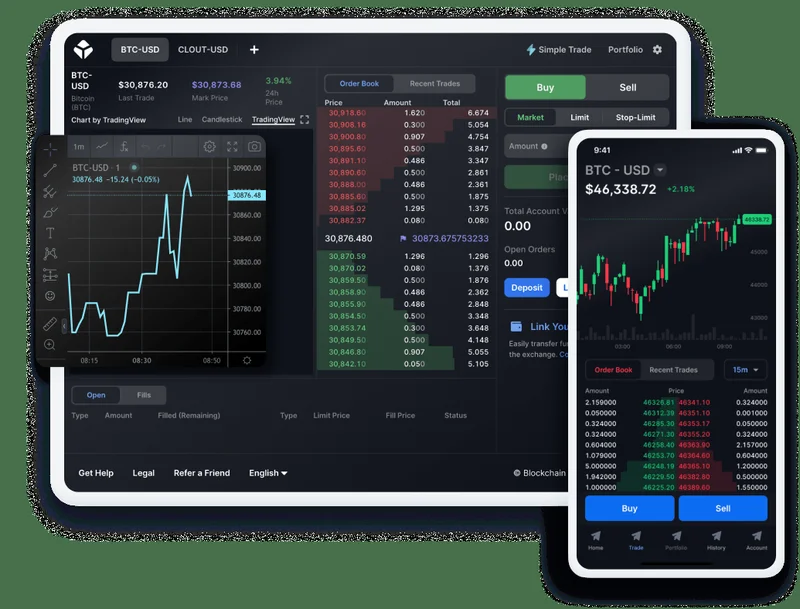

Into this environment of impatience enters BlockchainFX (BFX), a project that isn't just promising a new technology, but a new economic model. It has already pulled in over $10 million in its presale, a figure that demands a closer look, and a trend highlighted in reports like BlockchainFX Presale Is Rising As The Alternative As Investors Scramble In Wake Of Altcoin Price Slumps. The marketing narrative is compelling: a multi-asset "super app" with a robust staking and burn mechanism. But my interest isn't in the narrative. It’s in the numbers and the incentive structures that underpin it. Is BFX a sustainable ecosystem, or is it a beautifully engineered financial instrument designed for a spectacular, but perhaps short-lived, launch?

Let’s set aside the hype and analyze the mechanics.

The Architecture of Incentive

At its core, the BlockchainFX presale is a masterclass in demand engineering. The structure is designed to create a powerful sense of urgency and a clear, quantifiable reason to participate early. The token is currently priced at $0.029, with a stated launch price of $0.05. That’s a pre-programmed paper gain of over 70%—to be more precise, a 72.4% increase—for anyone buying in at the current tier. This isn't speculative; it's a fixed part of the launch sequence.

This built-in appreciation is then amplified by short-term incentives. The "CANDY40" Halloween bonus, offering a 40% token bonus, is a classic accelerant. It’s designed to compress the buying window and trigger a cascade of social proof. When potential investors see the presale funds ticking rapidly upward, it creates a feedback loop of FOMO. It’s effective, but it’s financial engineering, not organic growth.

The real story, however, begins after the presale closes. The sustainability of the entire BFX ecosystem hinges on its tokenomic model, which is both ambitious and fraught with dependencies. The project promises to channel 70% of all trading fees back into the ecosystem. Of this, 50% is distributed to stakers and 20% is used for token buybacks, with half of those repurchased tokens being permanently burned.

This mechanism is like a high-performance engine. When it's running, it's incredibly powerful. The staking rewards provide a direct incentive to hold, while the buy-and-burn mechanism creates deflationary pressure, theoretically increasing the value of the remaining tokens. But this engine requires a constant, high-octane fuel source: trading fees. Without a massive and consistent volume of trades on the platform, the engine sputters. What happens to the staking rewards and the deflationary pressure if the "super app" fails to attract a critical mass of users from day one?

A Wager on Execution

This brings us to the central variable: the "super app" itself. BlockchainFX is promising a unified platform for trading crypto, stocks, forex, and ETFs. This is an extraordinarily ambitious goal. It aims to compete not just with decentralized exchanges, but with established fintech giants and legacy brokerage houses. Pulling liquidity and users from so many different verticals into a single new platform is a monumental operational challenge.

And this is the part of the model that I find genuinely puzzling. The entire rewards engine is a direct derivative of trading fees. The promises of lucrative passive income are entirely contingent on a level of platform activity that is, as of now, purely hypothetical. We have detailed information on the tokenomics but scant data on the team’s experience in building and scaling a multi-market trading platform of this complexity. Who are they, and have they done this before?

To its credit, the project attempts to answer the "utility" question with the BFX Visa Card (available only to presale participants, a classic scarcity tactic). This is a strategically sound move. It creates a tangible bridge between digital rewards and real-world spending, allowing users to spend their staking yields at the grocery store. It’s a powerful feature that gives BFX a utility layer that projects like Polkadot and Chainlink, for all their infrastructural importance, simply don't offer to the average holder.

The card transforms an abstract staking reward into a concrete financial tool. This is a significant differentiator. It provides a compelling reason to participate in the ecosystem beyond pure speculation. But even this utility is a downstream effect of the trading platform's success. The card is the exhaust pipe; the trading engine is what makes the car move. Can they build the engine?

A High-Leverage Financial Instrument

Ultimately, an investment in the BFX presale isn't just a bet on a token. It's a high-leverage bet on the executive capability of an unknown team. The tokenomics are cleverly designed to maximize early-stage momentum and create a self-reinforcing loop of rewards and deflationary pressure. On paper, it’s an elegant model.

But models are not reality. The project's success or failure rests almost entirely on its ability to deliver a complex, multi-asset trading platform that can attract enough volume to fuel its own tokenomic engine. The risk isn't a flaw in the economic theory; it's the immense operational hurdle of execution. The presale provides the launch capital, but it doesn't guarantee the outcome. This is a calculated gamble that the "super app" will become a reality, and a wildly profitable one if it does. The question every potential investor must answer is whether the potential reward justifies the very real execution risk.

Tags: BlockchainFX

The Future Arriving Today: Why Today's Headlines Are Shaping Tomorrow

Next PostReddit's Stock Is Suddenly Surging: The Earnings Beat and Why I'm Not Buying the Hype

Related Articles