Upst Stock and Q3 Earnings Miss: What We Know

Title: Upstart's AI Hype vs. Harsh Reality: Can Loan Originations Outrun Negative Cash Flow?

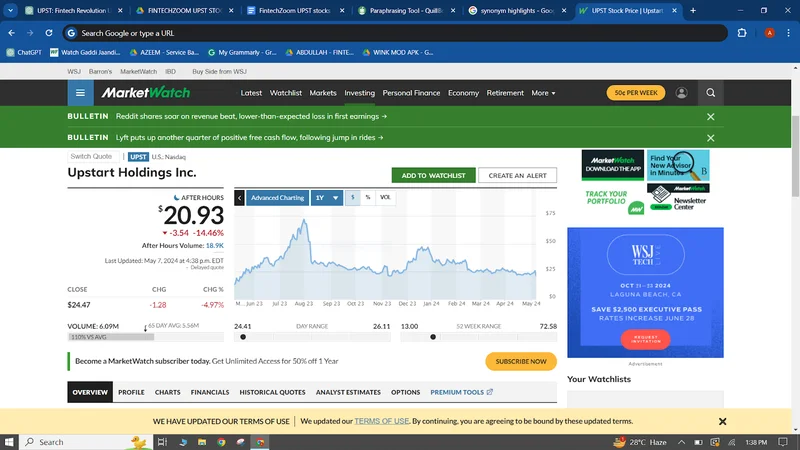

Upstart Holdings (UPST) took a beating in after-hours trading, down over 6% after releasing its Q3 earnings. The headline? A mixed bag. Adjusted EPS of $0.52 beat expectations of $0.43. Revenue, however, missed, coming in at $277.11M against an estimated $285.22M. The market hates misses, even small ones. Upstart Holdings Down 6% in After Hours Following Q3 Earnings Miss

Growth vs. Fundamentals: The Upstart Dilemma

Let’s break this down. Revenue climbed a healthy 71% year-over-year, and loan originations – the lifeblood of Upstart’s platform – surged 80% to $2.9B. That’s the good news, the kind of growth that gets investors excited about AI-driven lending platforms. And the company swung back to GAAP profitability, posting a net income of $31.81M compared to a loss last year. Adjusted EBITDA? A massive jump to $71.16M.

But here’s where the story gets complicated, and where the market’s skepticism starts to feel justified. Operating cash flow went negative – to the tune of -$256.28M. Free cash flow? Even worse at -$270.58M. That’s a pretty significant discrepancy between reported profitability and actual cash generation.

Now, management will likely argue this is due to timing issues, or working capital dynamics. Maybe. But a nearly $300 million cash outflow is hard to wave away with hand-waving. It raises a fundamental question: is Upstart’s business model inherently cash-intensive, or is this a temporary hiccup? (And let's be honest, every management team always says it's temporary).

The company's balance sheet shows $2.16B in total liabilities against $489.78M in cash and $743.72M in shareholders’ equity. Those numbers aren't disastrous, but they also aren't exactly comforting when you're burning through cash at this rate.

The AI Narrative vs. the Cash Flow Statement

CEO Dave Girouard emphasized Upstart’s “AI leadership,” claiming the platform is “performing exactly as designed, rapidly adapting to evolving macro signals while delivering strong results.” And sure, over 90% loan automation is impressive. It suggests their AI credit decisioning model is maturing. Fee revenue grew 54% year-over-year to $259M, which also sounds promising.

But I've looked at hundreds of these filings, and the aggressive emphasis on "AI leadership" combined with these cash flow numbers feels… discordant. It's like a tech company trying to distract you with shiny objects while hiding the fact that the engine is sputtering.

The critical question is this: Can Upstart scale its loan originations fast enough to outrun its negative cash flow? Management’s Q4 revenue guidance of approximately $288M and adjusted EBITDA of $63M suggests they believe they can. Full-year revenue guidance is $1.035B. But those are just projections. The cash flow statement is reality.

I'm also curious about the quality of those loans. If Upstart's AI is so good at predicting creditworthiness, why the need to burn so much cash? Are they originating riskier loans to juice growth, hoping the AI can mitigate the risk? Or are there structural issues in their funding model that force them to spend more upfront? Details on this are scarce, but it’s the kind of question analysts should be hammering on the earnings call.

AI Savior or Financial Mirage?

Upstart's story is a classic case of growth versus fundamentals. The AI narrative is compelling, and the loan origination numbers are undeniably impressive. But the negative cash flow is a flashing red light that can’t be ignored. Until Upstart can demonstrate that its AI-driven lending platform can generate sustainable, positive cash flow, the market's skepticism is warranted.

Tags: upst stock

Colossal Biosciences Acquires Viagen: What's the Endgame?

Next PostBitcoin Price: What's Going On?

Related Articles