VIX Surges Amid Nvidia's Stumble: What Happened and Why?

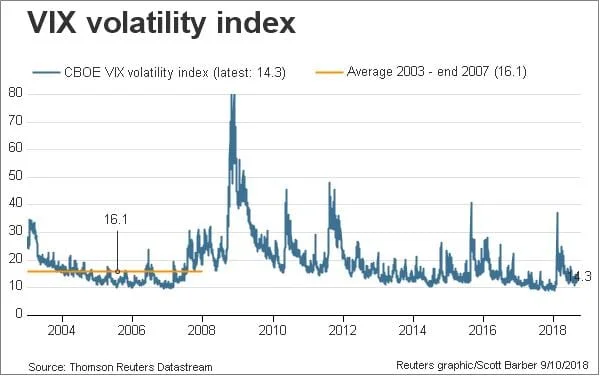

Alright, folks, buckle up. You're seeing headlines scream about a "VIX spike," and the market doing a little dance of uncertainty after Nvidia's earnings rally faded. But before you start panic-selling, let's zoom out for a second. I'm seeing something completely different here. The VIX isn’t a harbinger of doom. It's a pressure release valve before the real AI revolution kicks off.

Think of it like this: Imagine you're launching a rocket. You need a controlled explosion to break free from gravity, right? That VIX spike is the market equivalent of that controlled burst, shaking off the excess baggage of hype and speculation so that the truly transformative AI companies can really take off. The market had priced in perfection before seeing the earnings. Now it has seen the earnings, and it is going to price in the real value.

The Great AI Reset

What we're witnessing isn't a collapse of the AI dream; it's a recalibration. Nvidia posted incredible numbers – Q3 revenue of $57.01 billion, blowing past expectations, and forecasting Q4 revenue of $65 billion! And yet, the stock dropped. Why? Because the market's expectations were even HIGHER. It's a classic case of "priced-in perfection."

But here's the thing: that initial over-excitement wasn't entirely misplaced. It just needed a reality check. Think back to the dot-com boom. There was tons of hype, a lot of overvalued companies, and then… the bubble burst. But did the internet disappear? Absolutely not. It went through a painful but necessary cleansing, paving the way for the Amazons, Googles, and Metas of today. This is the same pattern, just playing out with AI.

We're seeing the initial froth dissipate, leaving behind the companies with real substance, real innovation, and real long-term potential. The fact that Walmart is up over 5% after boosting its sales forecast tells you that consumer spending is still strong, and that means the underlying economy is more resilient than the VIX spike might suggest. This isn't a sign of systemic collapse. It's a sign of a healthy, albeit volatile, market adjusting to a new reality.

And that reality is this: AI is not a fad. It's a fundamental shift in how we live, work, and interact with the world. It’s like the shift from mechanical to digital watches. The original smart watches were awful, but the idea was right. Now, Apple Watch is ubiquitous. The market will find the right product.

The labor market data, while mixed, also paints an interesting picture. Initial unemployment claims are down, showing underlying strength. Continuing claims are up, suggesting it's getting harder for people to find new jobs. But think about what that really means: it means companies are becoming more selective, demanding higher skills and expertise. This is a natural consequence of the AI revolution. As AI automates routine tasks, the demand for human workers shifts towards higher-value, more creative roles. It might be scary, but it is also an opportunity.

What does this mean for us? It means we need to adapt, learn new skills, and embrace the opportunities that AI creates. Remember, every technological revolution creates new jobs and new industries that we can't even imagine today. And it also means we need to be thoughtful about the ethical implications of AI. As AI becomes more powerful, we need to ensure it's used responsibly and for the benefit of all humanity. I know, I know: "ethics." But if we don't think about it, who will?

When I saw the VIX jump, I honestly felt a surge of excitement. It’s the kind of breakthrough that reminds me why I got into this field in the first place. The VIX surge, coupled with a fading Nvidia earnings rally, caused stocks to reverse course, as reported by Nasdaq Stocks Reverse Course as Nvidia Earnings Rally Fades, VIX Spikes.

The Calm *Before* the AI Storm

Tags: vix

BOB (Build on Bitcoin): The Latest Hype and Why It's Probably More Noise Than Signal

Next PostUber Ride: Cost vs. Convenience and What We Know

Related Articles